Since 2005 startup accelerators have provided cohorts of startups with mentoring, pitch practice, and product focus. However, accelerator Demo Days are a combination of graduation ceremony and pitch contest, with the uncomfortable feel of a swimsuit competition. Other than “I’ll know it when I see it”, there’s no formal way for an investor attending Demo Day to assess project maturity or quantify risks. Other than measuring engineering progress, there’s no standard language to communicate progress.

Corporations running internal incubators face many of the same selection issues as startup investors, plus they must grapple with the issues of integrating new ideas into existing P&L-driven functions or business units.

What’s been missing for everyone is:

- a common language for investors to communicate objectives to startups

- a language corporate innovation groups can use to communicate to business units and finance

- data that investors, accelerators and incubators can use to inform selection.

While it doesn’t eliminate great investor judgment, pattern recognition skills and mentoring, we’ve developed an Investment Readiness Level tool that fills in these missing pieces.

Investment Readiness Level (IRL) for Corporations and Investors

The startups in our Lean LaunchPad classes and the NSF I-Corps incubator use LaunchPad Central to collect a continuous stream of data across all the teams. Over 10 weeks each team gets out of the building talking to 100 customers to test their hypotheses across all 9 boxes in the business model canvas.

We track each team’s progress as they test their business model hypotheses. We collect the complete narrative of what they discovered talking to customers as well as aggregate interviews, hypotheses to test, invalidated hypotheses and mentor and instructor engagements. This data gives innovation managers and investors a feel for the evidence and trajectory of the cohort as a whole and a top-level view of each teams progress. The software rolls all the data into an Investment Readiness Level score.

(Take a quick read of the post on the Investment Readiness Level—it’s short. Or watch the video here.)

The Power of the Investment Readiness Level: Different Metrics for Different Industry Segments

Recently we ran a Lean LaunchPad for Life Sciences class with 26 teams of clinicians and researchers at UCSF. The teams developed businesses in four different areas—therapeutics, diagnostics, medical devices and digital health. To understand the power of this tool, look at how the VC overseeing each market segment modified the Investment Readiness Level so that it reflected metrics relevant to their particular industry.

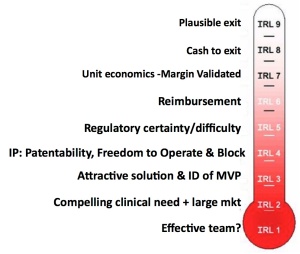

Medical Devices

Allan May of Life Science Angels modified the standard Investment Readiness Level to include metrics that were specific for medical device startups. These included: identification of a compelling clinical need, large enough market, intellectual property, regulatory issues, and reimbursement, and whether there was a plausible exit.

In the pictures below, note that all the thermometers are visual proxies for the more detailed evaluation criteria that lie behind them.

You can watch the entire presentation here

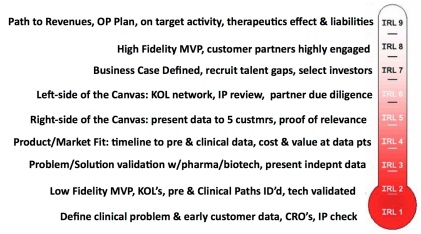

Therapeutics

Karl Handelsman of CMEA Capital modified the standard Investment Readiness Level (IRL) for teams developing therapeutics to include identifying clinical problems, and agreeing on a timeline to pre-clinical and clinical data, cost and value of data points, what quality data to deliver to a company, and building a Key Opinion Leader (KOL) network. The heart of the therapeutics IRL also required “Proof of relevance” – was there a path to revenues fully articulated, an operational plan defined. Finally, did the team understand the key therapeutic liabilities, have data proving on-target activity and evidence of a therapeutic effect.

You can see the entire presentation here

Digital Health

For teams developing Digital Health solutions, Abhas Gupta of MDV noted that the Investment Readiness Level was closest to the standard web/mobile/cloud model with the addition of reimbursement and technical validation.

Diagnostics

Todd Morrill wanted teams developing Diagnostics to have a reimbursement strategy fully documented, the necessary IP in place, regulation and technical validation (clinical trial) regime understood and described and the cost structure and financing needs well documented.

You can see the entire presentation here

For their final presentations, each team explained how they tested and validated their business model (value proposition, customer segment, channel, customer relationships, revenue, costs, activities, resources and partners.) But they also scored themselves using the Investment Readiness Level criteria for their market. After the teams reported the results of their self-evaluation, the VC’s then told them how they actually scored. We were fascinated to see that the team scores and the VC scores were almost the same.

Lessons Learned

- The Investment Readiness Level provides a “how are we doing” set of metrics

- It also creates a common language and metrics that investors, corporate innovation groups and entrepreneurs can share

- It’s flexible enough to be modified for industry-specific business models

- It’s part of a much larger suite of tools for those who manage corporate innovation, accelerators and incubators

P.S. if you want to learn more abut the IRL and other tools, we teach a 2-day class for corporate innovation, accelerators and incubators. Info here

This post originally appeared on Steve Blank’s blog and is republished by permission.